Click on the illustrations to enlarge them.

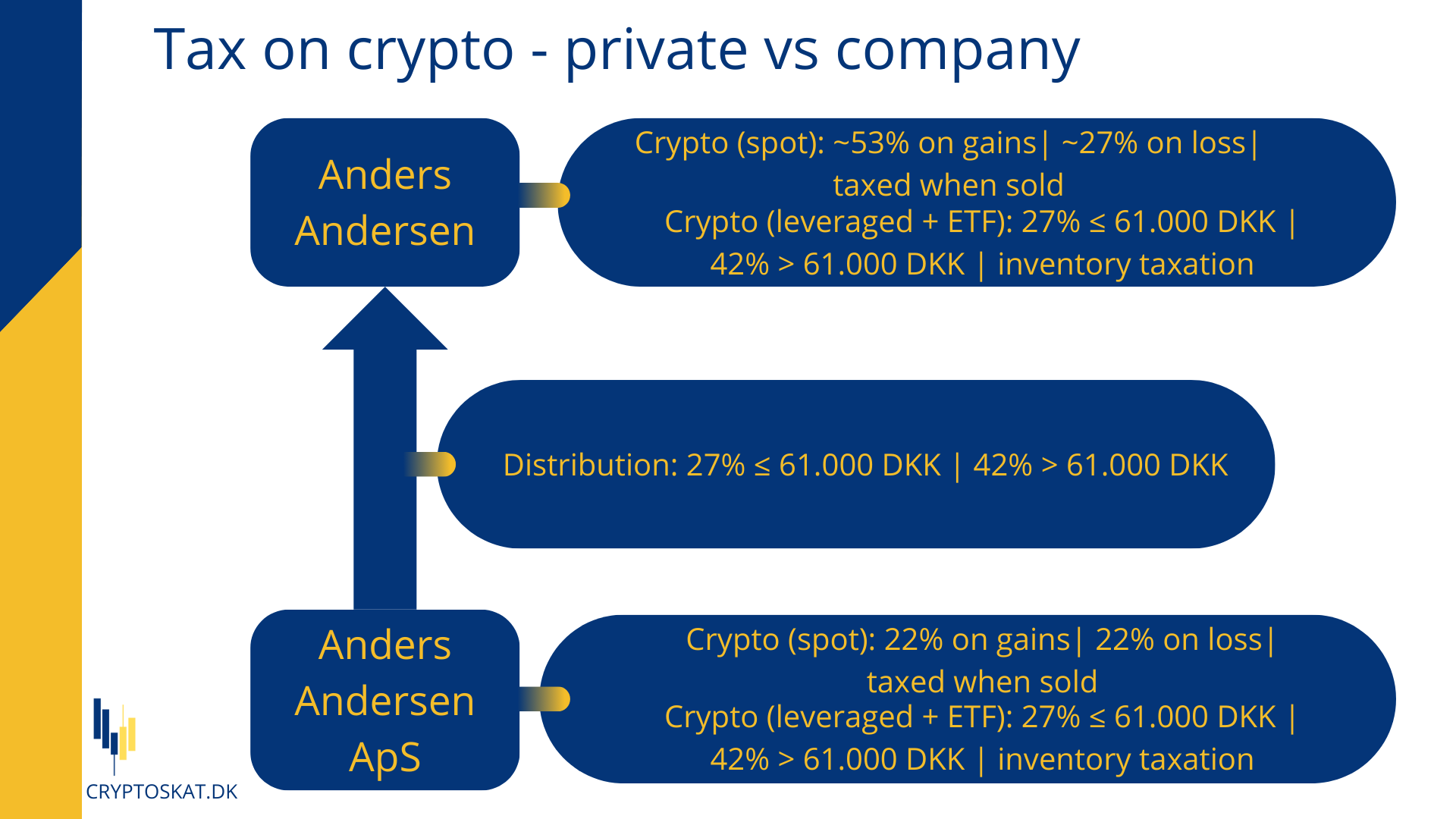

The taxation of crypto varies significantly depending on whether you trade crypto privately or through a company (an A/S or an ApS).

This is because private trades are taxed according to the State Tax Act (spot trades) and the Capital Gains Tax Act (leveraged trades). If you set up and trade through a company instead, the trades are taxed according to corporate tax rules. This has some different consequences which you can get an overview of on the illustrations on this page.

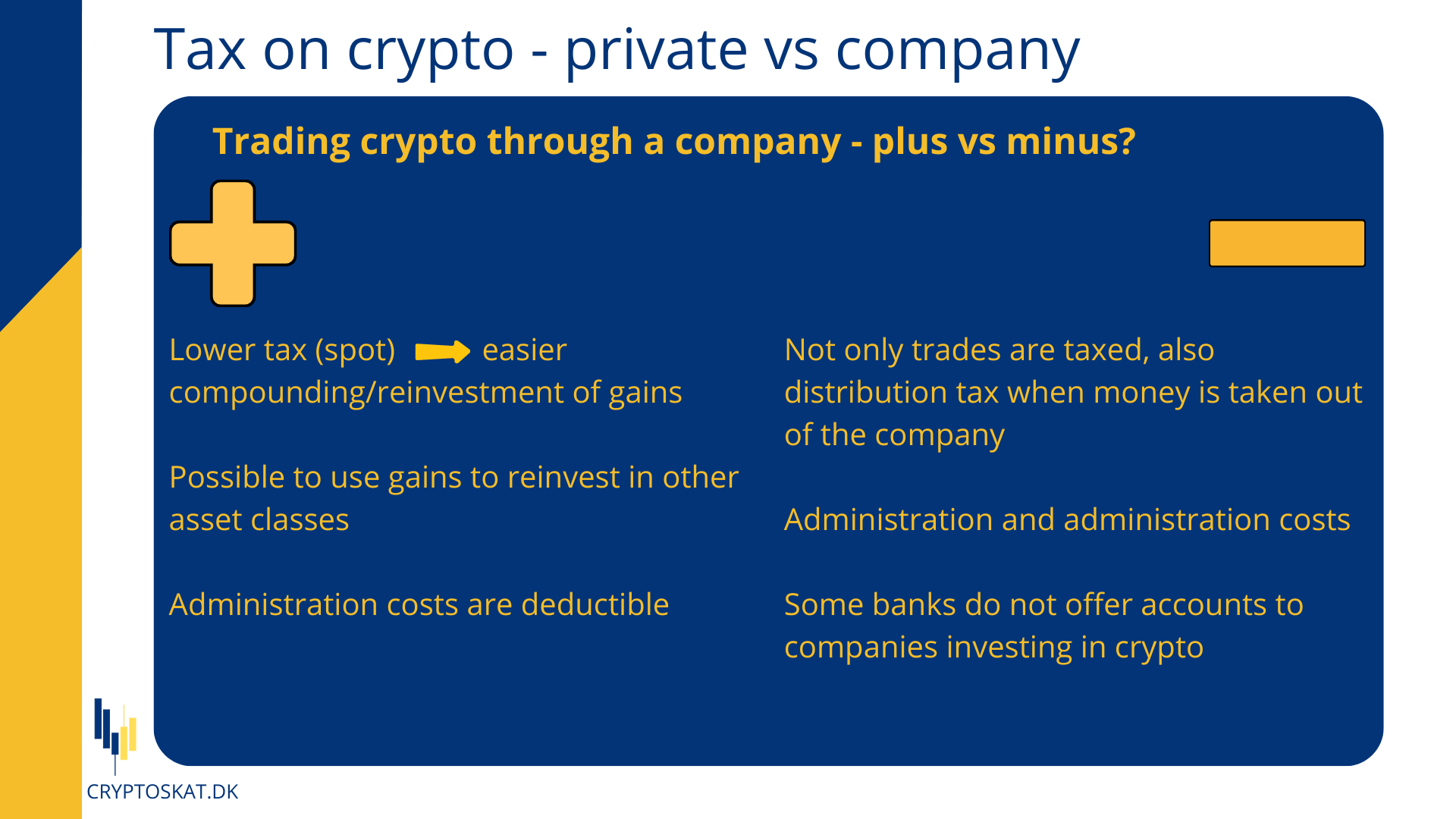

In short, the taxation of spot trades is asymmetrical when trading privately (higher tax on profits than deduction for losses). This is not the case when trading through a company – where you are only taxed on the net profit, and the tax rate is significantly lower (22%), compared to private trading (~53%).

However, an important detail is that when trading through a company, taxation occurs twice: The company is taxed on the profit. If/when the profit is subsequently withdrawn from the company for personal use (through distribution), tax must be paid again.

See the illustrations for the current tax rates (2024).

Please note: CryptoSkat does not provide legal advice. Our overview of Danish tax legislation on this page is based on our own understanding of the regulation and based on a detailed review of case law on the subject from the Danish tax authorities and courts. We base the CryptoSkat calculation methods on the requirements following from the authorities’ demands and guidelines.